DeFi TVL Falls to Yearly Low As Over $27 Billion ExitsThe Market

The Intelligent Insurer #65: Some analysts believe the technology is to blame

2022 has been a tumultuous year for digital asset investors so far. With the crypto market still bleeding, DeFi investors are bemoaning losses as the market's total value plummets. Over the past week, the DeFi space lost over $24 billion worth of digital assets as market sentiments took a downturn.

The latest Intelligent Insurer will analyze the present market conditions and a few factors driving the DeFi selloff. We will also consider the next step for the DeFi industry and what investors can do. First, we bring you exciting updates from our software development team.

Insured Finance software development update

Providing our users with top-notch services has always been our commitment and we strive to be as thorough as possible in developing features for our next-gen insurance platform. Over the past week, we completed unit testing for all smart contract failure coverage APIs. This will allow us to quickly detect breaking changes to any of the APIs.

We have also completed the low-fidelity (lo-fi) prototype for making a claim and claim assessors voting. We're currently done with the backend development and are now moving over to the front-end development for making a claim and claim assessors voting. The design for these features is already in progress.

Additionally, we are creating the UI designs for coverage and reward claiming for when a claim result has been decided. Policyholders and voters will utilize this interface to claim their coverage and voting rewards.

As our mainnet deployment approaches speedily, we're also focused on developing a wallet ahead of the launch. We're confident and positive that our conscious efforts over the past months will benefit our users and provide them with a secure digital asset insurance experience.

DeFi's total value falls 35% from December 2021 records

The amount of money tied up in DeFi protocols and decentralized applications (dApps), called the total value locked (TVL), has reached its lowest point over the past year. According to data from DeFiLlama, the total value of assets in DeFi protocols is currently $153.36 billion, down more than 35% from its December 2021 highs of $253 billion.

Curve Finance, the biggest DeFi platform with a $15.28 billion TVL, slumped by 18.9% over the past week, with Terra-based Anchor Protocol taking the biggest hit with a 60% slump in the same time frame. The money market has been experiencing decreased deposits amid ongoing issues with the Terra ecosystem's algorithmic stablecoin, UST.

Amongst the elite DeFi platforms, the leading lending platform, MakerDAO, suffered the lowest hit, slumping 8.9% over the past week, and dYdX was the most resilient. The decentralized exchange (DEX) grew its TVL by 0.30% in the past week.

Amid a broader market downtrend, analysts have suggested that the underlying assets locked in DeFi protocols were responsible for the decline. DeFi tokens lost an average of 34% of their value over the past week as global markets face uncertainties and interest in risky assets waned.

Kate Kurbanova, the co-founder of the risk management firm Apostro, said "The decline in DeFi TVL we’re currently seeing is caused mainly by the overall market downtrend – on the one hand, a lot of assets locked in DeFi protocols are highly volatile and their value decreased with the market dip… On the other hand, we should count on the fear which usually comes with the downtrend and people exiting their positions (volatile) into stablecoins or fiat – which also drives value away." While Kurbanova believes that the broader market decline is to blame, not all analysts share the same sentiment.

Fault in underlying technology

Analysts have suggested that the technology behind DeFi applications is to blame for the latest decline in the market's TVL. Wil Barnes, CEO of DeFi lending and borrowing firm, Jet Protocol is convinced that the technology upon which these DeFi protocols are built is still underdeveloped. He said, "The actual tech hasn’t caught up to the valuations yet."

Barnes made reference to a series of network outages that have plagued the supposed high-performance blockchain, Solana. These recurring network outages on the Solana network have undermined investor confidence when interacting with DeFi applications built on its ecosystem.

The outages left investors unable to exit their positions, and they were left to pay the price as they faced forced liquidations. This is especially true for traders who took loans with collateralized assets and could not save their assets from the market meltdown as the network struggled with congestion.

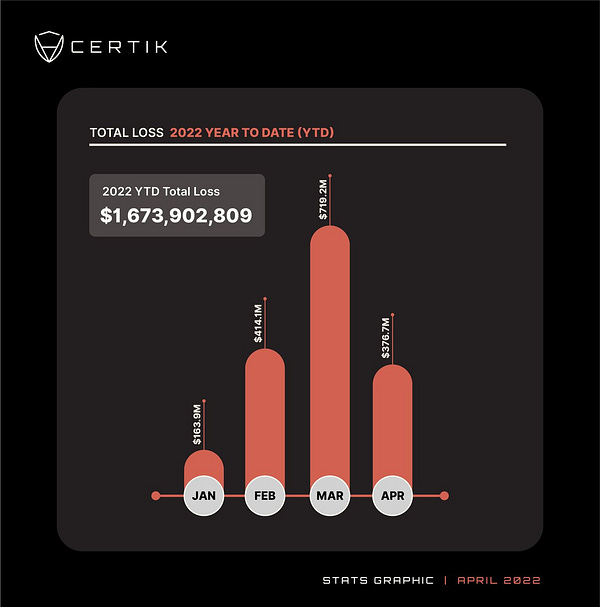

Vulnerabilities in DeFi protocols are also a contributing factor, as it has heightened DeFi risks, prompting most investors to pull out. DeFi-related hacks, scams, flash loan attacks, and more have stealthily increased in volume over the past few years. A new report from the blockchain security firm, CertiK, reveals that investors have lost over $1.6 billion worth of digital assets in 2022 alone.

The underinsured state of the DeFi sector is also not helping matters, considering that less than 5% of the entire DeFi market is insured. This leaves investors vulnerable to these attacks and exploits. In March alone, hackers stole almost $720 million worth of digital assets, which is $200 million more than the figure recorded in all of 2020.

This figure is largely due to the Ronin Bridge exploit, which saw the attackers cart away over $600 million worth of crypto. The proliferation of these attacks and exploits has undermined investors' confidence and with global markets tumbling, investors are converting to risk-off assets.

An opportunity for improvement

According to Barnes, the present slump in the DeFi market could present an opportunity for "everyone who wants to be around an opportunity to join projects they want to be a part of, to join communities they want to be a part of and get ready for the next round of innovation." Protocol developers can reduce the occurrence of vulnerabilities resulting from smart contract failures by having their code audited by reputable auditing firms. Criminals often exploit loopholes in DeFi protocol codes to attack projects and steal investors' funds.

Investors must also enhance their knowledge of the industry. Investors often lose their funds due to a lack of technical knowledge on how to use certain DeFi applications. Therefore, they must learn as much as they can about these protocols before interacting with them.

Developing more insurance solutions will also boost confidence in the market's growth and encourage institutional adoption. While these solutions are still not developed on a larger scale, investors would do well to take full advantage of insurance products like the ones offered by Insured Finance. These products give investors assurance that their digital assets are secure, allowing them to participate fully in the market.

About Insured Finance

Insured Finance is a decentralized, peer-to-peer insurance marketplace. Users can request customized insurance on a wide variety of digital assets, thereby ensuring full protection. Those fulfilling requests can earn premiums and earn a competitive return on their capital. Claims are fully collateralized and settled instantly.