How the Stablecoin Market Unfolded After UST’s Collapse

The Intelligent Insurer #67: Stablecoins react differently to UST's collapse

Earlier this month, the digital asset industry suffered a huge setback after Terra's algorithmic stablecoin, UST, depegged from the US dollar. This initiated a chain reaction that wiped over $26 billion from the stablecoin market, rendered LUNA worthless, and left investors with massive unrealized losses. UST's failure has since raised the question: What is the best type of stablecoin: fiat-backed, crypto-backed, or algorithmic?

In the latest Intelligent Insurer, we look at the UST fiasco and how different types of stablecoins reacted in the aftermath of the crash. We will also consider how investors can remain safe while choosing the best stablecoin that suits their investment goals. First, we bring you updates from our development team.

Insured Finance software development update

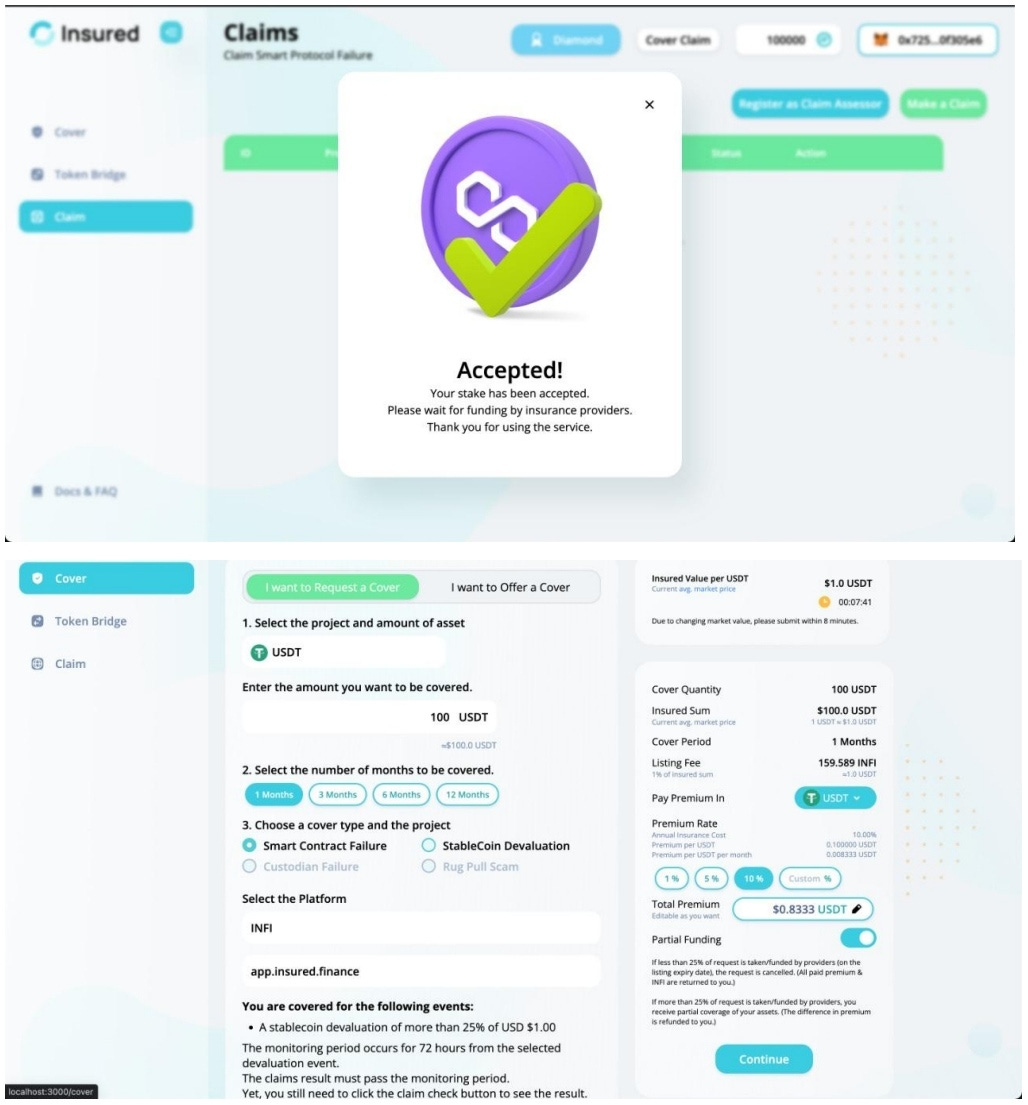

We are always excited to keep our users in the loop about the progress we are making toward the launch of our next-gen digital asset insurance platform. Over the past week, we completed frontend development for making a claim and claim assessors voting.

We developed the pages for the claim assessor registration process and also added smart contract failure as an option when requesting coverage. To give users a clue as to what this looks like, here are some screenshots of those pages.

While we've made massive progress over the past week, we are still not done. We will continue working on the remaining frontend development process for making a claim and claim assessors voting. We are executing tasks thoroughly to provide users with the best experience.

The biggest task we have at hand is creating a wallet for mainnet deployment. The development process for this is going smoothly as well. We are all looking forward to the official launch of our mainnet, which is imminent.

UST rocks the stablecoin market

Over the past two weeks, the crypto market faced a major downturn as UST depegged from the US dollar. The algorithmic stablecoin's failure began when an anonymous wallet dumped over $500 million worth of UST. Whether this was a reaction to the market's increased volatility or a malicious attack on Terra's system is a topic of debate.

To rescue UST, the LFG emptied its Bitcoin reserve, but this did nothing to stop the stablecoin's collapse. Investors flocked to sell their UST once the stablecoin couldn't retain its peg. Consequently, UST's sister coin, LUNA, was dragged into the fiasco and it lost about 99.9% of its value.

The damage was not limited to the Terra ecosystem. The crash exacerbated the prevalent bearish market, pulling the entire crypto market down. In all, the Terra UST collapse wiped over $26 billion from the stablecoin market and more than $700 billion from the digital asset market.

Leading crypto research and investment firm Delphi Digital noted that it is sitting on "massive unrealized losses" from its UST and LUNA investments. The firm noted that Terra's collapse is the most catastrophic event in the industry since Mt. Gox, the defunct crypto exchange that lost 850,000 BTC to hackers in 2014.

Meanwhile, Terraform Labs CEO Do Kwon recently unveiled a controversial plan to revive the Terra ecosystem. The plan involves forking the Terra blockchain, abandoning UST, and creating new LUNA tokens. So far, Kwon's revival plans have been met with criticism and skepticism from the crypto community.

How different stablecoins reacted to UST’s collapse

Investors have different reasons for preferring one stablecoin over another. While some prefer to invest in algorithmic stablecoins like UST because of their decentralized nature, there is the risk of no underlying asset to back them. Others choose fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) because there is an actual asset backing the coin to maintain its peg.

However, given the centralized nature of these digital assets, there is the risk of a bank run due to their exposure to commercial paper. Then there are crypto-collateralized stablecoins like DAI, that are backed by an excess supply of other cryptocurrencies.

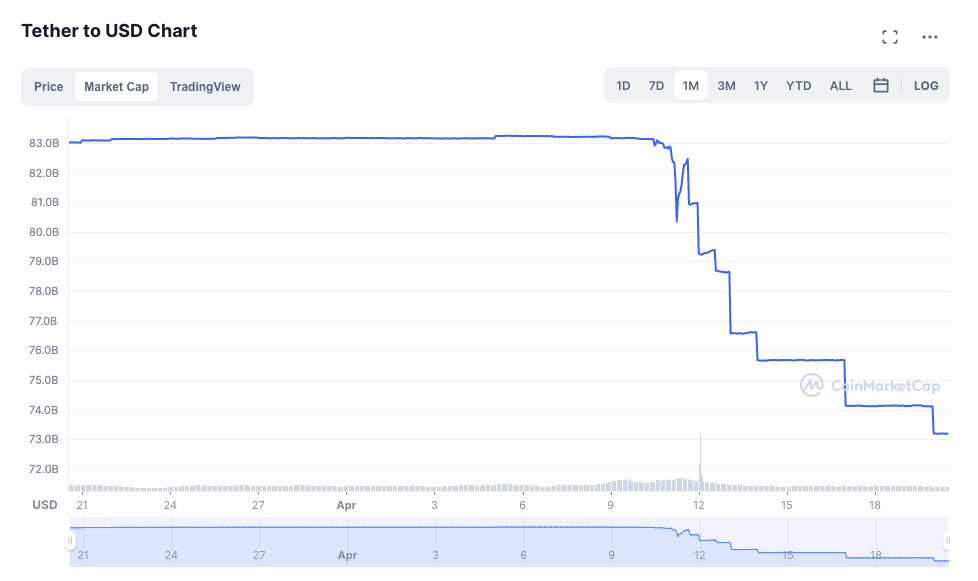

These stablecoins reacted differently to the UST crash. The market leader, USDT, briefly lost its dollar peg as its price dropped as low as $0.95. Tether’s CTO Paolo Ardoino noted that the firm "redeemed [$7 billion] in 48 hours, without the blink of an eye." Within this period, USDT’s market cap plummeted from over $83 billion to the current $73.23 billion.

(Source: CoinMarketCap)

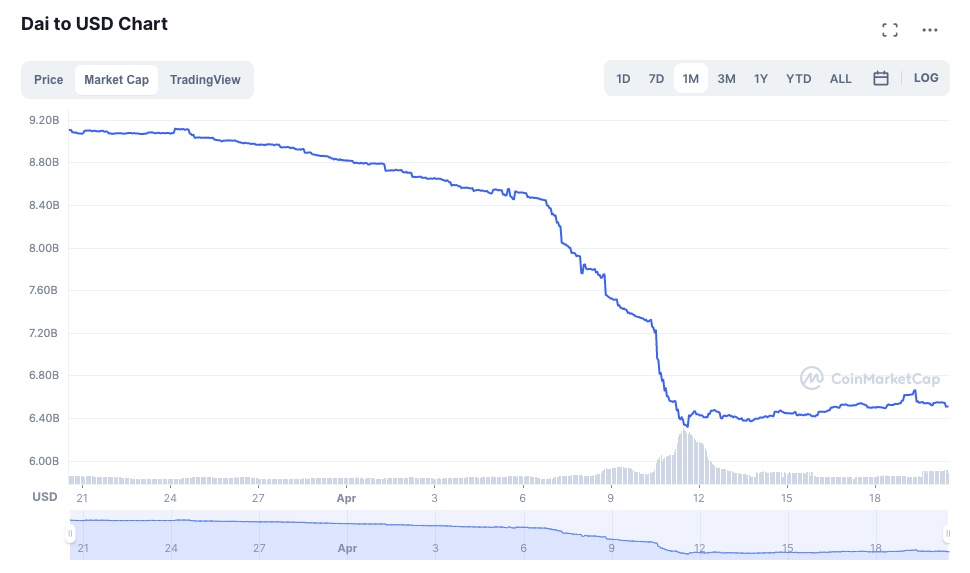

Amid the market crash, a lot was going on in the MakerDAO ecosystem and its DAI stablecoin. DAI is an algorithmic stablecoin but is also collateralized. The stablecoin managed to hold its peg at the peak of market volatility, with its price oscillating from $0.99 to over $1. Still, despite DAI's ability to navigate market volatility, the stablecoin faced more than 257 liquidations over the last two weeks. Similar to USDT's steep drop, DAI's market cap plunged from a little over $8 billion but found a floor and is currently sitting at $6.5 billion.

(Source: CoinMarketCap)

What is even more spectacular about DAI's performance over the past two weeks is that several other algorithmic stablecoins suffered the same fate as UST. While everyone is sounding the death knell for algorithmic stablecoins, DAI survived. Having existed since 2017, DAI has survived many extreme conditions in the market, something no other algorithmic stablecoin ever managed to do.

In all, the big winner from the UST crash was USDC. The stablecoin maintained its peg during market volatility, only deviating by a few cents. While UST was headed for zero and USDT was processing billions in redemptions, USDC was padding its market cap. According to data from CoinMarketCap, USDC had a market cap between $48 billion and $49 billion at the start of the crash. Following an almost unnoticeable dip, it began its upward trajectory and is currently sitting above $53 billion, near its March all-time high of $53.6 billion.

(Source: CoinMarketCap)

No shortage of risk in the digital asset industry

While some stablecoins fared better than others, it is also imperative to note that there is no shortage of risk in the digital asset industry. Investors must guard their digital assets at all times. Although it is impossible to accurately predict the outcome of a blockchain project, investors must do their due diligence. Long before the UST crash, several market analysts warned of the risks posed by Terra's mechanism. They were also the first to say "I told you so" when the Terra ecosystem crashed.

Additionally, it is vital to pay heed to the rule of never investing more than you can afford to lose. In the aftermath of the crash, there have been anecdotal reports of self-harm by those who had most of their savings staked in UST. Although these reports cannot be confirmed, it is clear that a lot of investors lost huge sums of money in the collapse.

Ultimately, the importance of adding an insurance product to investment portfolios can not be overemphasized. These insurance products, such as the ones offered by Insured Finance, add an extra layer of protection for investors. Insured Finance can also offer protection against stablecoin failure. With an insurance solution in their portfolios, investors are guaranteed that their assets are safe, even in the event of unexpected incidents like the UST crash.

About Insured Finance

Insured Finance is a decentralized, peer-to-peer insurance marketplace. Users can request customized insurance on a wide variety of digital assets, thereby ensuring full protection. Those fulfilling requests can earn premiums and earn a competitive return on their capital. Claims are fully collateralized and settled instantly.